What is professional judgment?

When there are unusual situations or circumstances that impact your federal student aid eligibility, federal regulations give a financial aid administrator discretion or professional judgment on a case-by-case basis and with adequate documentation to make adjustments to the data elements on the Free Application for Federal Student Aid (FAFSA®) form that impact your Expected Family Contribution (EFC) to gain a more accurate assessment of your family's ability to contribute to your cost of education. The Department of Education does not have the authority to override a school's professional judgment decision.

There are 3 main types of professional judgments.

Special Circumstances

The Free Application for Federal Student Aid (FAFSA) uses income information from two year's prior and does not allow students the opportunity to explain if there has been a change in circumstances. Therefore, under federal law, financial aid administrators have been given the authority to take some circumstances into account and make adjustments to certain items on the FAFSA application, potentially impacting the EFC and as a result, the financial aid eligibility.

Circumstances we may be able to consider:

Circumstances we will not be able to consider:

Graduate/Professional students do not qualify for need-based grants or loans and would not likely benefit from the Special Circumstance process. Student’s seeking a second bachelor’s degree do not qualify for need-based grants. Please contact USI Financial Assistance to discuss if a Special Circumstance would still benefit you.

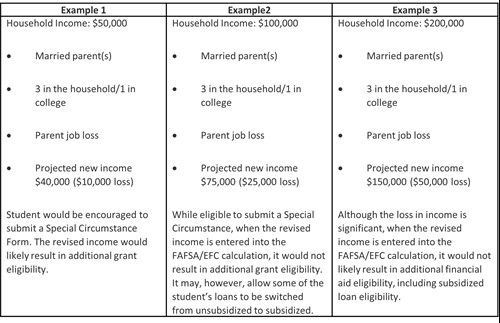

Remember, there must be very good reasons for the Financial Aid Office to make any adjustments. Not all adjustments will change your financial aid eligibility (see examples below) and you'll have to provide adequate proof to support those adjustments. Also, remember that the Financial Aid Office’s decision is final and cannot be appealed to the U.S. Department of Education.

**It is important to note that the examples above are very general. The FAFSA/EFC calculation looks at everything from marital status, household size, number in college, taxable income, untaxed income, assets, etc.**

If you have extenuating circumstances, you may download and complete the Special Circumstance Form online in the Student Financial Assistance forms library for the application. Please submit all requested documentation with the form. Incomplete Special Conditions will not be processed. Submission of this form does not guarantee approval.**It is important to note that the examples above are very general. The FAFSA/EFC calculation looks at everything from marital status, household size, number in college, taxable income, untaxed income, assets, etc.**

Dependency Overrides

Many students feel they are independent because they currently live on their own or because their parents no longer claim them on their income taxes. Others feel they should be considered independent because their parents refuse to provide information on the FAFSA or because their parents cannot afford to help with college expenses. However, these reasons are not sufficient for an appeal.

We are required to consider parent information and expect a parental contribution for students who are not independent according to the U.S. Department of Education. Check out the video on this page or visit the U.S. Department of Education's Federal Student Aid website for more information about dependency status.

There are extenuating circumstances that may warrant a Dependency Override. Dependency Overrides may only be performed when adequate documentation of extenuating family circumstances exists. Extenuating circumstances are generally defined by students' inability to have contact with their parents.

Circumstances we may be able to consider:

Circumstances we will not be able to consider:

If you have extenuating circumstances, you may download and complete the Dependency Override online in the Student Financial Assistance forms library for the application. Please submit all requested documentation with the form. Incomplete Dependency Overrides will not be processed. Submission of this form does not guarantee approval.

Budget Adjustments

The Financial Aid Budget, also known as the Cost of Attendance (COA), includes allowances for tuition and fees, housing and food, books and supplies, and other miscellaneous expenses. The allowances are determined with consideration for direct costs (costs billed to the student) and indirect costs (costs not billed to the student).

Approval of a Budget Adjustment Appeal only adjusts the budget, not your billed costs. It will not likely result in additional grant or scholarship eligibility and will not automatically increase any loans already borrowed. Increasing your COA may allow for additional borrowing through the Direct Loan Program(s) if you have not already been awarded the maximum amounts permitted for your dependency status, grade level and degree; the Direct PLUS Loan or Graduate PLUS Loan programs; or an alternative private student loan.

This type of adjustment is typically only beneficial when your financial aid has been reduced due to being over-budget. This means that the total amount of financial assistance you qualify for exceeds your Financial Aid Budget/COA.

Circumstances we may be able to consider:

Circumstances we will not be able to consider:

If you have extenuating circumstances, you may download and complete the Budget Adjustment Appeal online in the Student Financial Assistance forms library for the application. Please submit all requested documentation with the form. Incomplete Budget Adjustment Appeals will not be processed. Submission of this form does not guarantee approval.

Quick Aid Resources

More at USI

For Faculty & Staff